Executive Summary

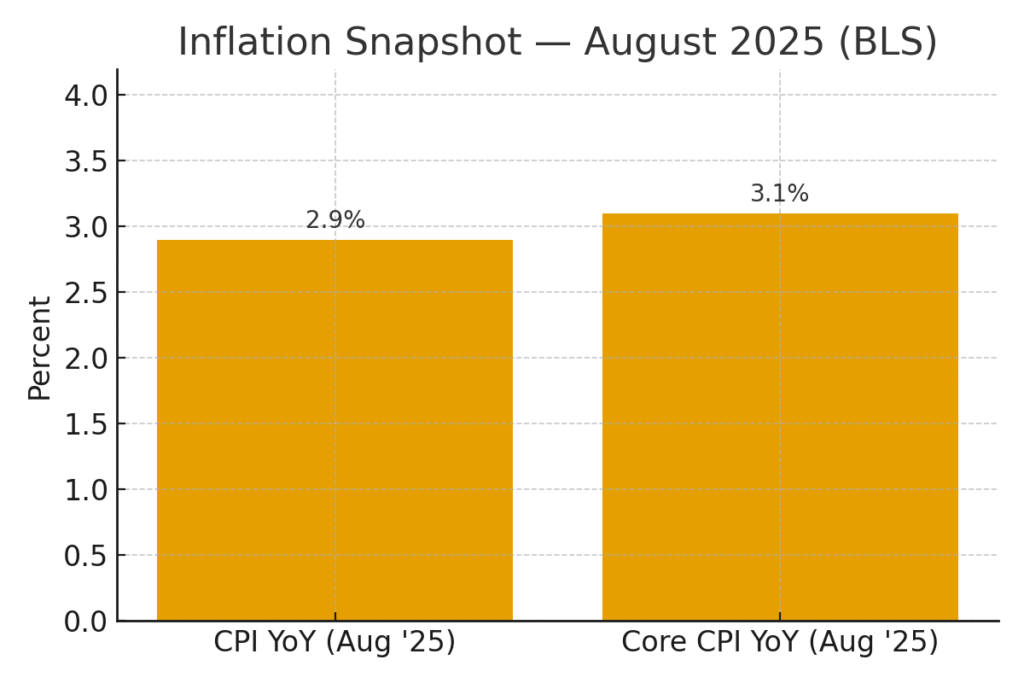

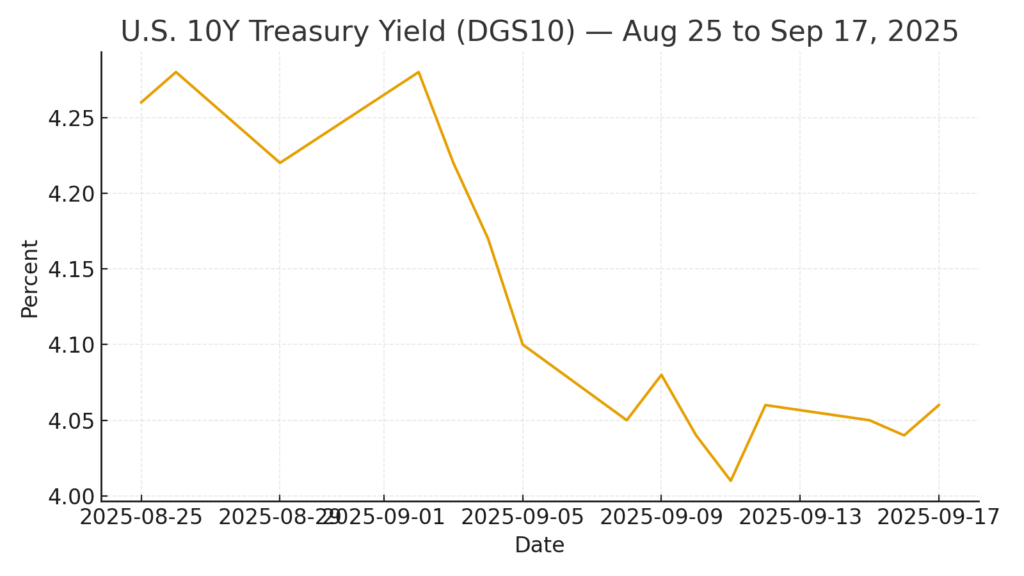

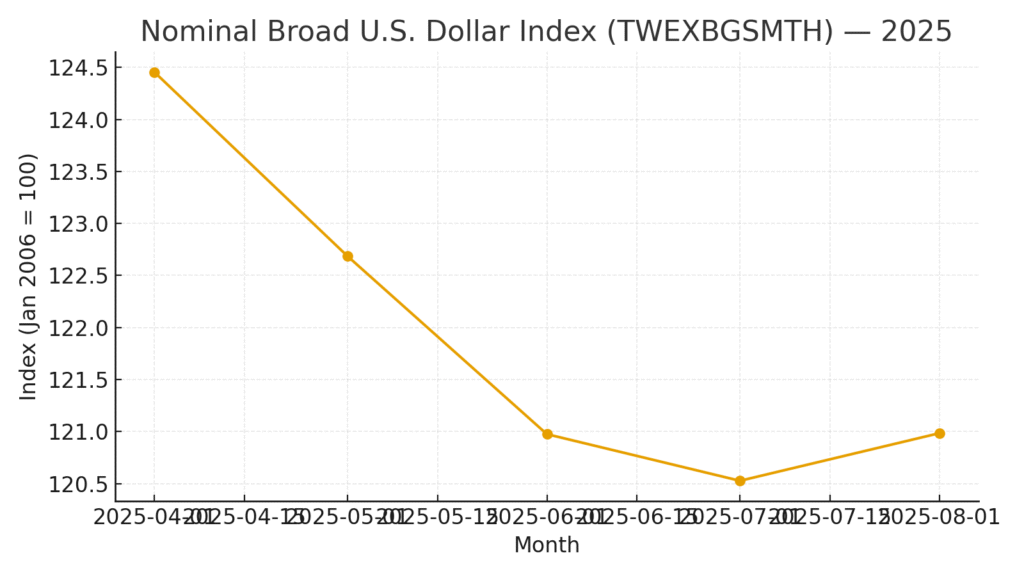

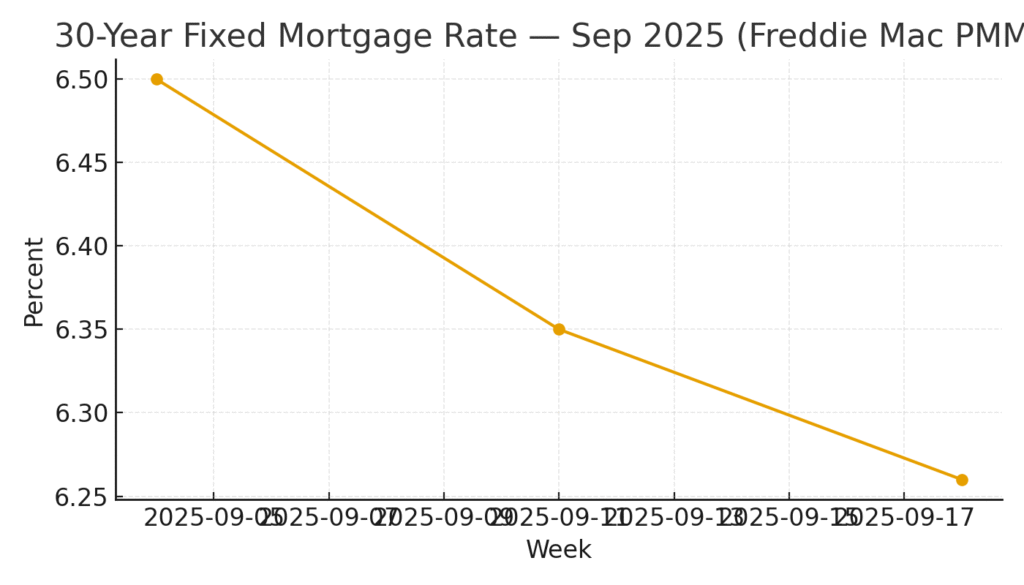

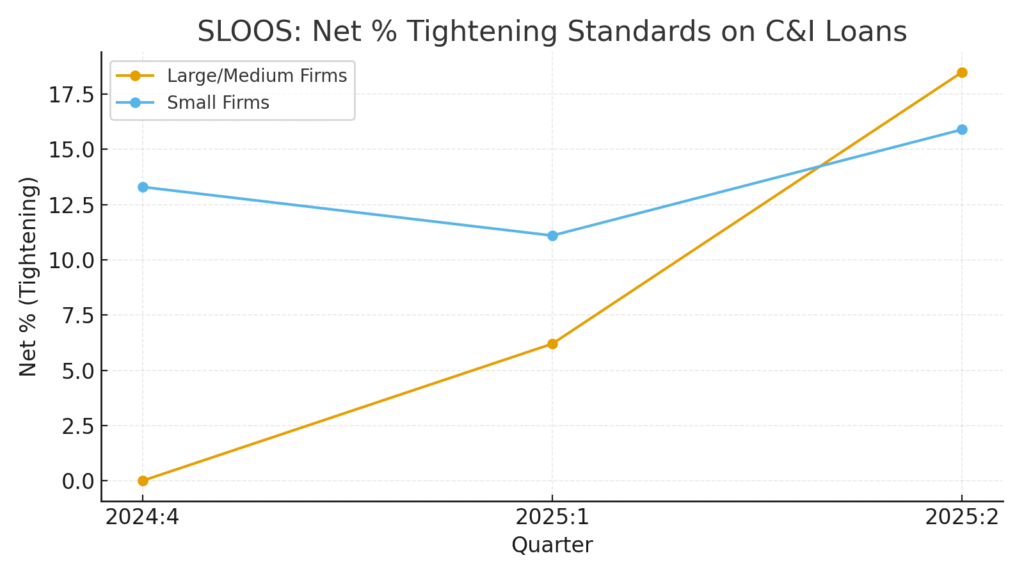

The Federal Reserve lowered the target range by 25 bps to 4.00–4.25% while continuing QT. Inflation is easing but still sticky in services (CPI YoY 2.9%, Core CPI 3.1% — Aug 2025, BLS). The labor market is cooling (unemployment ~4.3%), and credit standards remain tight (Fed SLOOS shows renewed tightening in 2025:Q2). Long rates hovered near ~4.0–4.1% on the 10-year, the broad USD has softened through 2025, and 30-year mortgage rates have dipped toward ~6.25–6.35% (Freddie Mac PMMS).

Bottom line: This looks like an insurance cut, not a full pivot. The macro mix favors quality growth + rate-sensitives on one side and cash-flow-strong cyclicals on the other, with persistent dispersion across sectors.

Macro Pulse (from official releases)

- Policy: Fed funds 4.00–4.25%, QT ongoing (Fed statements, H.15).

- Inflation: CPI 2.9% YoY; Core CPI 3.1% (BLS, Aug 2025). Core PCE remains just under 3% (BEA).

- Labor: Unemployment ~4.3% with softer payroll momentum (BLS).

- Rates & FX: UST 10Y fluctuating around ~4.0–4.1%; broad USD index has eased in 2025 (Fed/TWEX).

- Housing Finance: 30-yr fixed mortgage ~6.26%–6.35% (Freddie Mac PMMS).

- Credit: 2025:Q2 SLOOS shows net tightening on C&I loans (Large/Medium firms ~18.5%, Small firms ~15.9%).

Sector-by-Sector Implications

1) Technology (Large-cap growth, AI, Cloud, Semis)

- Tailwinds: Lower/anchored long rates ↓ discount rates; softer USD supports overseas revenues; capex for AI/data infrastructure remains strong.

- Headwinds: If services inflation re-accelerates, a backup in long yields would hit duration-heavy multiples.

- Positioning idea: Favor quality growth (high FCF, pricing power). Hedge duration risk via rate caps or balanced exposure to cash-generative incumbents.

2) Financials (Banks, Diversifieds, Insurance)

- Banks: Front-end down while long end only modestly lower = potential NIM pressure; SLOOS points to sluggish loan demand and tighter standards. Mortgage refi/activity helps fee income but not enough to offset broad NIM squeeze.

- Insurance: Beneficiaries of higher long yields, but market-to-market swings persist.

- Positioning idea: Prefer scale lenders with low-cost deposits, fee businesses, and conservative CRE exposure; be selective in regionals.

3) Real Estate & Housing (REITs, Homebuilders, CRE)

- Residential: Mortgage rates have eased, unlocking some pent-up demand; financing remains not cheap with QT, but direction helps volumes.

- CRE: Office fundamentals still challenged; financing and refinancing risk elevated. Industrial/logistics and data-center REITs hold up better.

- Positioning idea: Focus on residential adjacencies (homebuilders, building products) and mission-critical REITs (logistics, towers, data centers).

4) Energy & Commodities

- USD softness is generally supportive for commodities; however, slower global demand caps price upside.

- Producers with disciplined capex and strong balance sheets should maintain cash returns.

- Positioning idea: Own capital-disciplined producers and midstream for carry; keep an eye on crack spreads and inventories.

5) Industrials & Materials

- Exports benefit from weaker USD; capex improves with cheaper financing but is constrained by tighter bank standards.

- Defense/Aero and infrastructure-linked names have structural support.

- Positioning idea: Tilt to order-backlog visibility, government-linked spend, and high switching-cost niches.

6) Consumer (Discretionary & Staples)

- Discretionary: Lower rates help autos & housing-linked retail, but rising unemployment tempers volumes.

- Staples: Pricing power + defensive cash flows stabilise earnings; less rate-sensitive.

- Positioning idea: Barbell: value-oriented discretionary with clean inventory + quality staples for ballast.

7) Utilities & Infrastructure

- Rate proxies that benefit from any drift lower in long yields. Regulated ROE and grid/renewables CAPEX provide growth visibility; AI-led data-center interconnect spend is an incremental positive.

- Positioning idea: Regulated utilities with constructive rate cases; selective clean-energy developers with funding secured.

Scenarios, Triggers, and Tilts

Base Case — “Insurance Cut” with Gradual Disinflation

- 10Y UST in ~3.8–4.3% range; USD softer vs. 2024; mortgage rates grind lower.

- Tilts: Quality growth (Tech/Comm Svcs), Utilities/Infrastructure, selective Energy; IG credit over HY; underweight CRE-heavy financials.

Upside Inflation Risk — Services Re-heating

- Core services firm; 10Y backs up; USD firms.

- Tilts: Value/cash-flow cyclicals, Energy, diversified Financials with trading/IB strength; trim high-duration growth.

Downside Growth Risk — Labor Weakness Broadens

- Payrolls disappoint; cuts accelerate at the front end; long end rallies.

- Tilts: REITs & Utilities outperform; cyclicals/industrials lag; favor duration-beneficiaries and high-quality IG credit.

Risk Management & What Would Change the View

- Breakout in core services inflation → neutralize duration-heavy growth, add value/energy.

- Sharp rise in unemployment (>~4.6–4.7%) with falling hours → shift to defensives, increase duration.

- Funding-market stress (RRP/SRF usage spikes, GC repo dislocations) → expect QT pace debate; add liquidity proxies.

- Exogenous shocks (geopolitics, supply disruptions) → raise cash buffers, tighten credit exposure.

What to Watch (all official)

- Inflation: BLS CPI mid-month; BEA PCE/Core PCE late month.

- Labor: BLS Employment Situation (first Friday), JOLTS for openings/quit rates.

- Credit: Fed SLOOS (quarterly) + H.8 bank credit.

- Rates/FX: Fed H.15, FRED series (DGS10, TWEX broad dollar).

- Housing Finance: Freddie Mac PMMS weekly mortgage rates.

Leave a Reply