Introduction

The U.S. economy is entering a delicate phase. Inflation has cooled from last year’s highs, but progress is stalling where it matters most—housing and services. At the same time, the labor market is losing steam, with unemployment at a four-year high. The Federal Reserve, having cut rates earlier this year, is now standing still, waiting for clearer signals. The question is: which side of the economy will blink first?

The Data: Latest Official Numbers

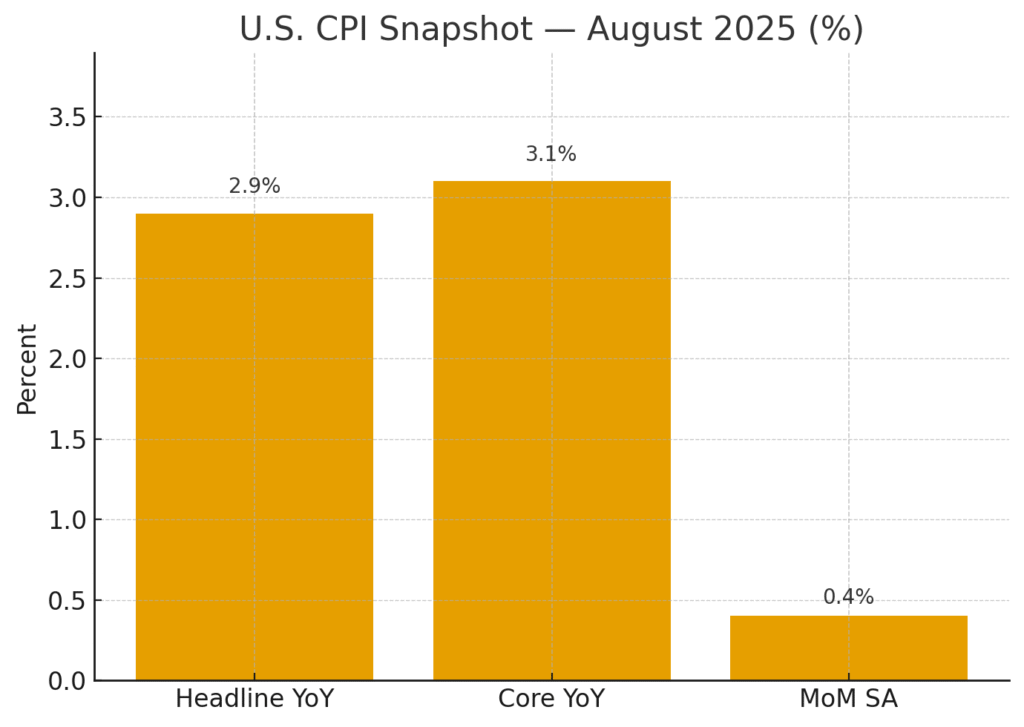

- Inflation (CPI, August 2025): Headline inflation rose to 2.9% year over year (July: 2.7%). Core CPI held at 3.1% YoY, with a monthly increase of 0.4% (seasonally adjusted).

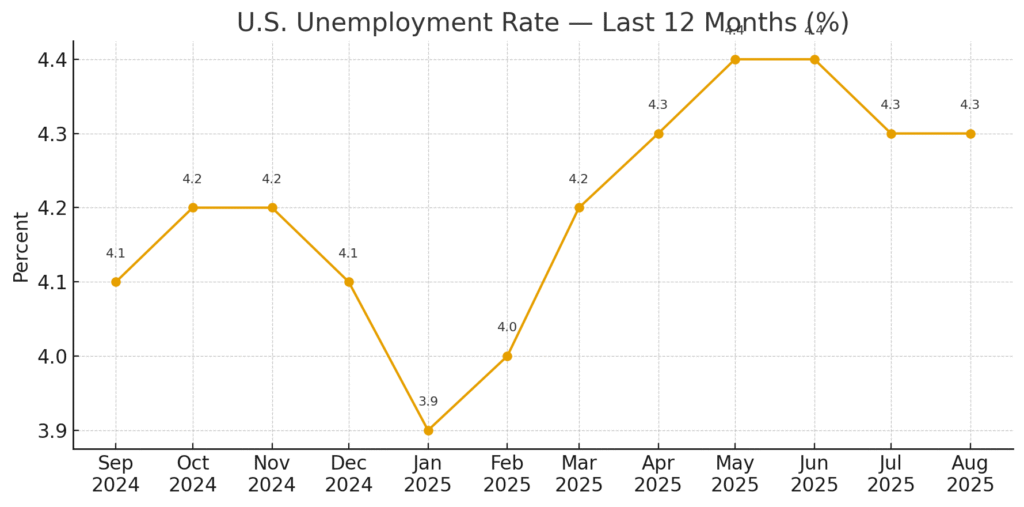

- Unemployment (August 2025): 4.3%, up from 4.2% in July. Long-term unemployment ticked higher; labor force participation steady at 62.3%.

- Wages: Average hourly earnings rose 3.7% YoY, a slower pace than earlier this year.

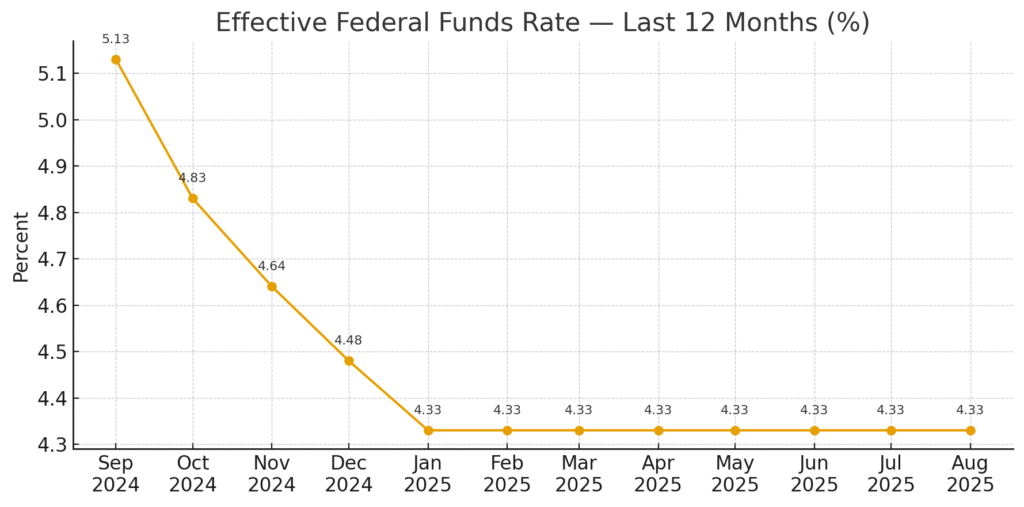

- Federal Funds Rate: Target range 4.25–4.50%, unchanged since January. Effective rate averaged 4.33%.

- Fed Projections (June SEP): 2025 year-end policy rate at 3.9%, unemployment at 4.5%, PCE inflation at 3.0%.

Visual Guide (Charts to Include)

- CPI Breakdown: Headline vs Core vs MoM (bar chart).

- Unemployment Rate: 12-month trend (line chart).

- Effective Federal Funds Rate: 12-month history showing the plateau (line chart).

Analysis & Scenarios

Base Case (Most Likely)

- Inflation continues to drift lower, but slowly; core remains above 3% until mid-2026.

- Unemployment rises modestly to 4.5%.

- Fed delivers two small rate cuts by year-end.

- Markets: Bond yields ease slightly, equities stay range-bound, USD weakens modestly.

Optimistic Scenario

- Shelter inflation decelerates faster than expected, services follow wages lower.

- CPI falls near 2.5% by early 2026.

- Fed cuts more aggressively (75–100 bps total).

- Markets: Bonds rally, equities gain on lower rates, gold softens as inflation fears fade.

Pessimistic Scenario

- Labor market weakens sharply; unemployment jumps above 4.7%.

- Consumer spending slows, recession risks rise.

- Fed forced into faster cuts, but credit spreads widen and equities wobble.

- Markets: Bond yields plunge, risk assets face volatility, USD weakens.

Policy and Global Context

Fed: Stuck in neutral, unwilling to cut aggressively until core services inflation eases. Data dependency is the guiding principle.

ECB & BoE: Europe faces weaker growth but lower inflation, allowing for earlier easing. The ECB is already more dovish.

Asia: Bank of Japan is cautiously normalizing policy, while China is easing to stabilize growth.

Global Impact: The U.S. slowdown coupled with sticky inflation could create divergence—U.S. rates staying higher for longer, while other central banks ease. This would affect currency flows and global risk appetite.

Reader Takeaway

- 📉 Inflation is stuck at ~3%: housing and services keep it sticky.

- 🧑💼 Unemployment rising to 4.3% signals cooling but not collapse.

- 🏦 Fed is cautious: no rush to cut, but risks could tilt policy either way.

- 🌍 Global divergence: U.S. may lag in cutting rates compared to Europe/Asia.

Conclusion

The U.S. economy is in a late-cycle balancing act. Inflation progress has stalled at the “last mile,” while the labor market is showing fatigue. The Fed is watching closely, with patience that could frustrate markets. For investors, the message is clear: base case is gradual easing, but the tails—stickier inflation or faster labor weakness—are equally dangerous. For businesses, borrowing costs will remain high, and demand growth slower, until one of these forces breaks.

Leave a Reply